Blogs

Would You Let $80 a Month Hold You Back from Buying a Home?

Would You Let $80 a Month Hold You Back from Buying a Home?

If you’re sitting on the sidelines of the housing market, watching mortgage rates hover in the low 6% range and thinking, “I’ll just wait until they dip into the 5s,” you’re not alone. Many potential buyers in West Palm Beach, North Palm Beach, or Wellington, FL, are doing exactly this — waiting for that small rate drop that might save them an extra $80 a month. But the real question is: Is it worth it?

In today’s rapidly evolving real estate landscape, affordability is still a major hurdle, but savvy buyers are discovering that the math doesn’t always support waiting. That little monthly saving you’re eyeing? It may not move the needle as much as you think. Meanwhile, the costs of delaying homeownership — including rising home prices and intensifying competition — could outweigh what you’re hoping to gain.

Let’s dig in.

Where Mortgage Rates Stand Right Now — and What That Means for You

The Current Mortgage Rates Picture

Over the past year, mortgage rates have seen meaningful — if not dramatic — movement. While rates once flirted with 7% (or even higher), they’ve since trended downward into the low-6% range. According to recent forecasts, many expert forecasters expect them to remain around this level for the foreseeable future. Forbes

This isn’t just national noise: locally, if you’re considering buying a home in West Palm Beach, North Palm Beach, or Wellington, this trend is especially relevant. As rates ease, your lender’s quote could be more favorable than what many buyers assumed a few months ago.

Why the Rate Drop Matters

A rate drop may sound technical, but it translates into real, monthly savings. For example, if you’re targeting a $400,000 mortgage (a reasonable number for many homes in Palm Beach County), even a half-percent difference in your interest rate can make a noticeable change in your typical monthly payment.

It’s not just about what you hope to pay — it’s also what you already might be saving, especially compared to a few months ago when things looked tougher.

The Real Savings — How Much You're Already Ahead

The “Hidden” Monthly Savings

Let’s walk through some real-world math.

Imagine this: you planned to buy earlier in the year, but the rates felt prohibitive. Back then, your lender might have quoted you something near 7% on a $400,000 home. Today? Rates are already lower. That’s not theoretical — that’s actual, built-in savings happening right now.

According to recent trends, that drop in rates has already shaved off almost $400 per month compared to what similar buyers would have paid in the spring. That’s not just a rounding error — it’s real cash flow.

Comparing Your Current Payment vs. the “Perfect” Rate

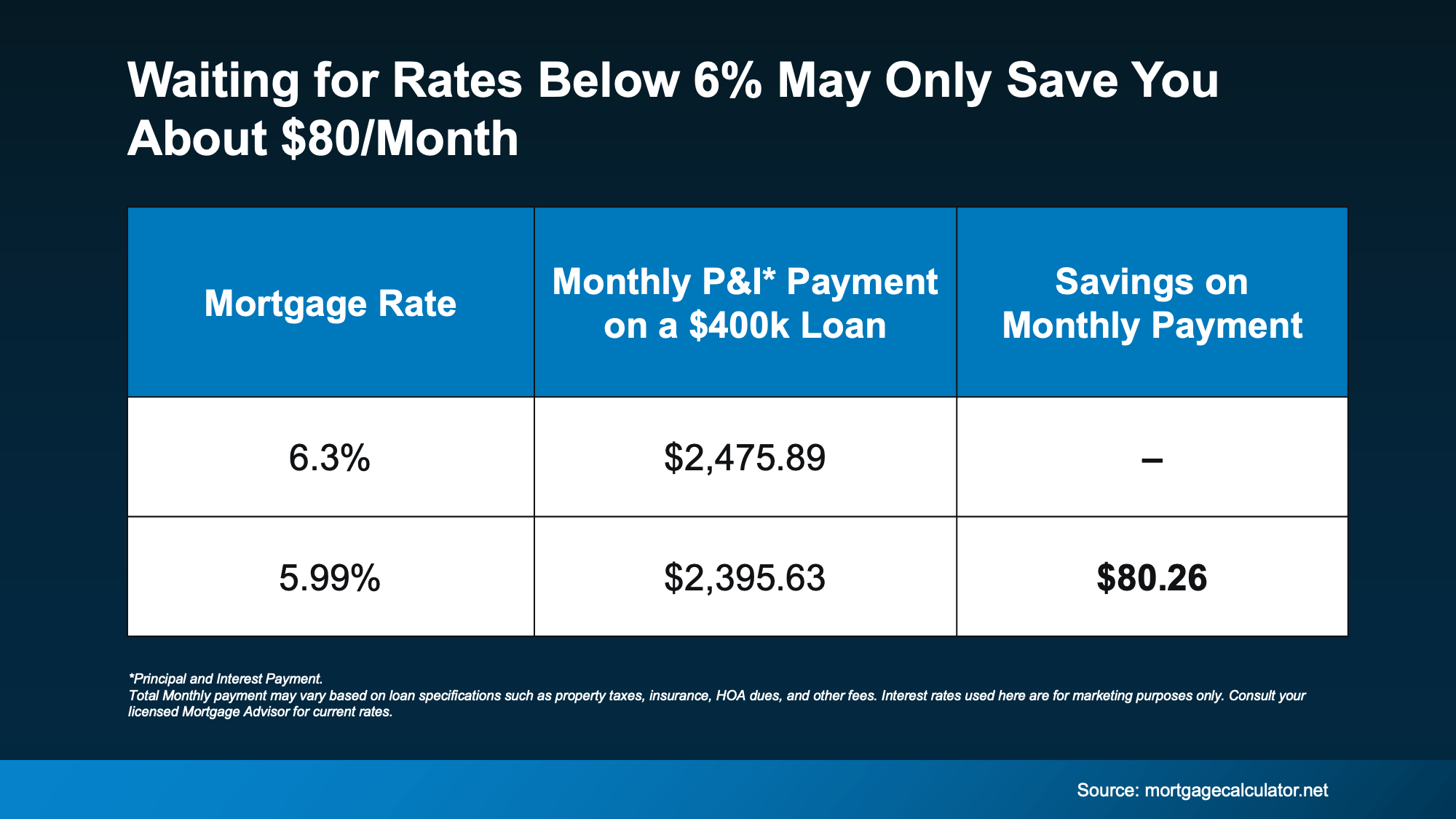

Okay, so you’re now thinking: “But what if rates go even lower — like 5.99%?” Let’s do the comparison.

At ~7% on a $400,000 loan, your typical monthly payment might have been quite a bit higher.

At a rate around 6.1%–6.3% (where many lenders are now), your payment drops significantly.

If rates hypothetically fall to 5.99%, you might only save about $80/month compared to your current payment (depending on your lender quote, closing costs, and loan terms).

That’s right — holding out for a small dip could cost you in opportunity.

Why Waiting for a Small Rate Drop Could Backfire

Competition Will Soon Ramp Up

Here’s something many buyers miss: once rates dip below certain thresholds, buyer behavior shifts, and competition intensifies significantly.

Currently, there are more homes to choose from in Palm Beach County, and many sellers in West Palm Beach, North Palm Beach, and Wellington are more motivated. But that could change fast. If rates slide below 6%, more households might re-enter the market — and that could mean bidding wars, quicker sales, and less negotiating power.

In fact, industry data suggests that when mortgage rates fall, more people qualify to buy median-priced homes, which increases competition. Waiting could mean losing out on the very advantages you have right now.

Expert Forecasts Are Lukewarm on Big Rate Drops

Many expert forecasters — including economists from Fannie Mae and the National Association of Realtors (NAR) — predict rates will remain in the mid-6% range for much of 2025, with only modest decreases in 2026. Forbes

For example, some forecasts suggest rates could dip into the high 5s next year, but not dramatically lower or quickly enough to justify putting your homeownership dreams on pause for a long time.

Rising Home Prices Might Outpace What You’re Waiting For

Even if rates fall a little more, home prices may continue to rise, especially in desirable areas like Wellington or North Palm Beach. According to local housing market data, median-priced home values in Palm Beach County remain strong. realtytimes.com+1

If you wait, the house you want might cost more later — and that could erase the extra $80 monthly savings you were hoping to get.

Local Snapshot: Palm Beach County & Your Buying Opportunity

To make this more concrete, let’s zoom in on the housing market in West Palm Beach, North Palm Beach, and Wellington.

Palm Beach County Housing Trends

In Palm Beach County, recent data shows the median sale price for single-family homes dipped slightly, while inventory has grown — giving buyers more leverage. realtytimes.com+2Capital Analytics Associates+2

According to a Comprehensive Housing Market Analysis, the home sales market in the West Palm Beach area is balanced, with roughly 6.8 months of inventory — meaning supply and demand are more level than in recent seller-favored years. HUD User

In Wellington, the median price for single-family homes is around $657,500, according to recent data, highlighting that this market remains strong and desirable. Property Focus

West Palm Beach Specifics

A recent Elliman report found the median sales price for single-family homes in West Palm Beach rose to about $590,000, while inventory increased significantly — a sweet spot for buyers. Douglas Elliman

Meanwhile, Zillow reports an average home value in West Palm Beach of around $391,081, with a 1-year drop of 5.9% as of late 2025. Zillow

Homes in this market are staying on the market longer, giving buyers negotiating advantages.

Wellington Snapshot

As noted, Wellington’s median single-family home price is around $657,500. Property Focus

Forecasts suggest inventory will remain elevated into mid-2026, which could translate into strong buyer leverage. jeanniehomesforsale.com

Because Wellington is known for its quality of life, family-oriented neighborhoods, and equestrian amenities, demand may stay stable even as rates shift.

Reframing the Question: Is $80 a Month Really Worth the Wait?

If you’re like many buyers in North Palm Beach or West Palm Beach, the thought process might go something like this:

“If I wait a little, I can shave off an extra $80/month. That’s worth it, right?”

But here’s how to reframe that question in a way that makes more sense for Home Buying Tips and smart financial planning:

What else could I do with that $80 saved now?

Put it toward a larger down payment

Make extra principal payments down the road

Invest it or use it for moving costs / home improvements

What risks am I taking by waiting?

The rate your lender quotes you today might not be available later

Home prices in West Palm Beach or Wellington could go up, especially as more buyers return

Competition could tighten, and you might lose out on desirable homes

What’s the opportunity cost?

If you find a home you love now, locking in might be more valuable than squeezing out a marginal monthly saving

Equity begins the day you close — delaying means delaying your investment growth

How stable are the rate forecasts?

Even expert forecasters aren’t calling for dramatic drops below 6% in the near term. Forbes

Waiting for a dream rate could mean missing out on the current window of opportunity.

What to Do If You’re a Buyer in West Palm Beach / North Palm Beach / Wellington

Step 1: Run Your Numbers with a Local Expert

Talk to a trusted Real Estate Agent and Mortgage Broker or Mortgage Lender who knows the Palm Beach County market inside and out. Here’s where Christian Penner, of America’s Mortgage Solutions (AMS), comes in:

Christian is a seasoned Mortgage Broker, Mortgage Lender, Real Estate Agent, and Real Estate Advisor, with deep expertise in West Palm Beach, North Palm Beach, and Wellington, FL.

He can help you get pre-approved, run affordability scenarios, and compare what different rate offerings actually mean for your typical monthly payment.

He can also guide you through negotiating offers and locking in rate options (or float-down clauses, if available).

Step 2: Lock in (or Float) Strategically

Once you’ve found a home you love, consider these options:

Rate lock: If your lender offers a competitive rate, locking in ensures you don’t lose it while you finalize your purchase.

Float-down option: If offered, this lets you lock in now but adjust if rates drop. (Christian Penner / AMS can help you find lenders who provide this.)

Shorter-term vs. longer-term loan: Use that “extra saved money” (from rate drops already realized) to pay more principal, shorten your term, or make larger down payment — improving equity or reducing interest cost.

Step 3: Negotiate Wisely in Today’s Market

Because inventory is growing in the Palm Beach County market (especially single-family homes), buyers have more leverage — particularly in West Palm Beach and Wellington:

Ask for seller concessions: closing costs, inspections, repairs.

Don’t shy away from making competitive offers, but with contingencies to protect you.

Use local market data (median days on market, inventory levels) to gauge how motivated sellers are.

Step 4: Stay Educated About Local Trends

Keep a pulse on what’s happening in the housing market in your area:

Read local reports (like those from Palm Beach County, real estate brokerages, or AMS).

Revisit your home-buying strategy if expert forecaster predictions shift materially.

Use home-buying tools (amortization calculators, affordability assessments) to forecast different scenarios — rate drops, price increases, different down payment levels.

Scenarios That Make Sense to Wait — and When They Don’t

It Might Make Sense to Wait If:

You’re flexible on timing and not emotionally tied to specific homes — you can afford to wait for a few months or more.

Your down payment is small, and you want to maximize “extra” savings to build more of it.

You have excellent credit, and you believe even a small rate drop could yield favorable loan terms.

You’re prepared for increased competition — and you’re confident you can compete when rates fall further.

It Probably Doesn’t Make Sense to Wait If:

You found a home you love in West Palm Beach, North Palm Beach, or Wellington, and it's priced attractively.

Your budget is tight, and the monthly payment now already works for you.

You want to start building equity and investing in homeownership sooner rather than later.

**You’re concerned about rising home prices or increased buyer competition later.

Bottom Line: Seize the Opportunity Before the $80 Becomes Unrealistic

Here’s what to remember:

The extra $80/month potential savings if rates drop slightly more is small compared to what you’ve already gained from recent rate declines.

Waiting could mean giving up your current buyer leverage, especially as more households re-enter the housing market once rates moderate.

Homeownership is not just about minimizing your monthly payment — it's about timing, long-term equity, and securing your place in a market that’s shifting.

If you’ve found a home you love in West Palm Beach, North Palm Beach, or Wellington, and the math works with your lender’s quote — a conversation with Christian Penner at America’s Mortgage Solutions (AMS) might be your smartest move. He can run detailed numbers for you, help lock in a competitive rate, and guide you confidently through the home-buying journey.

Ultimately, the question isn’t just “Would you let $80 hold you back from buying a home?” It’s “Would you let the opportunity you have today slip away for the sake of a small potential saving tomorrow?”

Frequently Asked Questions

Q1: How does a 0.5% drop in mortgage rate translate to monthly payment for a $400,000 loan?

A: Depending on your loan structure and term, dropping from ~6.3% to ~5.99% could save around $70–$90 a month on a $400,000 mortgage — but that depends on the rate your lender quotes you, your down payment, and other factors.

Q2: Will mortgage rates in 2026 go below 6%?

A: Some expert forecasters, like Fannie Mae, predict a dip toward the high 5s by mid-to-late 2026. Forbes But others believe rates may stay in the mid-6% range for longer. There’s no guarantee, and waiting for that dip could take time and risk losing current advantages.

Q3: Could home prices in West Palm Beach or Wellington go up if I wait?

A: Yes — local market data suggests prices are stabilizing but inventory is still tight in some neighborhoods. realtytimes.com+1 More buyers could enter the market if rates drop, which could drive prices higher in competitive submarkets.

Q4: How can I work with a Real Estate Advisor to plan smartly?

A: Partnering with someone like Christian Penner, who acts both as a Real Estate Agent and Mortgage Lender / Broker, gives you a holistic view. He can run affordability analyses, rate-lock strategies, and help you negotiate for the best possible deal on the homes you’re targeting.

FOR MORE INFO

Where Experts Say Rates Are Headed

For starters, most experts say mortgage rates are likely to stay pretty much where we are today throughout 2026. So, there’s no guarantee we’ll see a rate much lower than what we have now. Only one expert forecaster is saying rates could fall into the upper 5s next year (see graph below):

And even if rates do dip below 6%, the extra savings you’re holding out for won’t move the needle as much as you might expect.

The Real Math Behind a 5.99% Rate

Let’s break it down. If rates come down to 5.99% from where they've been lately that’s a difference of only about $80 a month on an average priced home – give or take a bit based on your price point and the rate your lender quotes you (see chart below):

Source: “America's Mortgage Solutions (AMS)”

Facebook

Facebook

Facebook

Instagram

Instagram

Youtube

LinkedIn

TikTok

X